Commlink #7

March 21 - 27, 2022

Weekly Review

Web3 can be such a mirage. Never before has there been such a convergence of technology and imaginative potential in history. We are almost fully free to immerse ourselves in the most outlandish version of our being and environment conceivable to the human mind. It’s an incredibly seductive allure beckoning us to engage in these directions. The metaverse, virtual worlds, simulation, endless horizons, transcendence of material and gravity, total liberation of the consciousness from the hum-drum of the daily grind. Who can resist? Answer: No one. We are all getting pulled into this vortex. And it can be so much fun!

At Community DAO, however, we posit our motto as “Connecting Web3 to the Real World.” This is a very important qualification, recalibrating, even contracting this expansive dream world into waking life. We assert that the execution of ideas requires more than just talk. Inherent in this qualification is the development of actual business objectives, real estate AND virtual estate, interactions between actual human beings in living communities, and follow through of concrete objectives, over and above abstract, theoretical applications. Where does the rubber hit the road? That’s what ultimately matters here, and in any age really. What can you do to show that you mean business?

This week we finally minted 10,000,000 Commtokens, after a prolonged period of debate and feedback, discussion of pro/cons and the confusion emerging from new trails through the wilderness of the web3 landscape and the often chaotic nature of the anarchic network effect of DAOs.

The C0MMs now exist on the Ravencoin blockchain. The Main Asset token can be viewed here: https://rvn.cryptoscope.io/asset/?asset_id=ae9cd7474be671c597bd44e45c1cd166a6ae755e

And the first tier, baseline C0MM/1 token can be viewed here:

https://rvn.cryptoscope.io/asset/?asset_id=d59c9a276da021f6e55758aadd759988dfee3182

Initial allocations into wallets have begun, with the formation of a bank based on a model of ancient Roman distribution of power known as the Triumvirate. More on the theory behind that to come in the future. Important thing for CommDAO members is to understand that we are now capable of tokenizing efforts made in service to this organization. Hooray! We have a pipeline in place for rewarding contributors.

In order to be able to receive C0MMs, you should open a wallet with Mango Farm Assets: https://mangofarmassets.com/, which is operated by Ravencoin. Check our resources and links further down for more resources regarding the Ravencoin blockchain.

Updates on P2E in CommDAO with C0MM rewards will be forthcoming.

Also, we have an exciting announcement to make in regards to an imminent collaboration with Alterverse, a new emerging Metaverse ecosystem powered by the exquisite Unreal Engine.

Check out all the vibrant columns beginning to surface each week within Commlink.

Hope you enjoy the show for another round!!!!

Stats

Twitter Followers: 948

Total Members: 368

Columns / Community Voices

Out Of This World

Have I heard voices? No.

Have I seen things that aren’t there? No.

But I’ve seen something that some people would say isn’t really there. He’s a miniature person that lives in a wooded hole behind my house. Does that count?

Yes? Okay...

I haven’t told anyone else about this. Because people are going to ask questions and they won’t believe me. And that is going to be frustrating, them doubting me. Because I know that he is real. He has actually been the most important person in my life for the past few months. He understands things that other people don’t and never lies to me.

The first time I met him was a foggy, soggy morning, immediately following heavy rain the afternoon and night prior. It was springtime and I was taking a walk in the woods as I’ve come to do several times a day. My focus was not on finding anything, in particular, but in escaping into the quiet for a few minutes.

Thirty acres of woods sit immediately behind my home. The woods have barely been touched by humans over the last 50 years, and there exists trees of multiple different types, ages, stages of decay and maturity. Maple, holly, oak, pine, sweet gum densely pack the wood. Many dead trees reside here, now lying across the ground and providing root space and food for new trees and vegetation. Peppered throughout are holes are in the ground big enough to accommodate a man’s leg. Root balls once resided here and have since rotted away.

In addition to the trees, the woods are adorned with thick round leaf greenbriar. The briars are so dense that, in the spring and summer, it is difficult to walk in the woods. I’ve cut trails in the back over the last couple of years, though, which allows much easier access. Dried sweet gum seed pods and dried leaves lie in abundance on the ground, forming the woods’ floor.

His home exists inside of a now empty root hole from a maple tree fallen several years ago. The hole is only about 2 feet across. There is a thick root from an adjacent tree that wraps around the top of the hole, giving it stability from caving in from the sides. The hole goes down about a foot before breaking off into 4 smaller holes which dive deeper still. These holes are remnants of the initial root branches and serve as different wings of his shelter.

It was during spring that I first met him. The tiny man. The briars were low and it was easy to trek into the far eastern part of the wood. That’s where he lives. I was sitting on a large fallen sweet-gum, moss overlying bark on the top half, bark stripped away on the half closer to the ground. From here, I stared down into a particularly deep root hole. From deep in the hole I noticed a flickering, then clearly a small light, then an arm and shoulder. A little man, no bigger than my index finger, was looking up at me.

This little man, were he to be human size, is probably in his mid-40s. He wore denim pants and a flannel shirt. His face was soft and relaxed, like he had seen me before. I felt scared. How could I be seeing such a miniature person, I must be going crazy! But he was as clear to me as the trees and moss all around that I know by faith and science to be real. And I relaxed, I think partly due to his calmness.

This began a ritual whereupon I would meet this man every morning before the sun rose. And I would talk to him of my concerns, small and large. And he would listen wisely, occasionally giving advice. I felt comfortable with him.

The man has been my sounding board for a lot of different ideas and concerns that I’ve had. He listens and only interjects or says something if he truly feels it is of great importance. And I appreciate that, given how people can be with their yammering. I look forward to our talks more than anything else. When we are talking I hear truth and he understands me.

He tells me to quiet my mind and take deep breaths in and out. He tells me that of course I am not in control of life’s events. Be happy and content with simply experiencing life. I don’t think he understands my little worldly worries about paying bills and the state of international affairs. He doesn’t understand because he doesn’t exist in that world. But he sympathizes greatly with me and can feel my pain. He knows that life is pain.

I’ve learned from him not to worry about what I think others are thinking. These thoughts are not reality. I can free myself by letting go of false expectations that I carry. That I didn’t even know I was carrying. I am no more or less significant than any other living thing. That will become apparent before this part of our journey ends and the next begins. Time, in its constant march forward, is not real. There is only the infinite moment.

You carry these false beliefs, too, you just probably don’t know it. You would enjoy meeting him.

So, no. I haven’t heard voices but I have met this man. You can understand, I‘m sure, why I haven’t told a lot of people about him. If people find out about him, they may try to find him and prevent him from telling his truth. You know that people hate the truth.

Do you have anymore questions?

The Rogi Report

DAO Ninjas Infiltrate Web3

Ultimately our work society has devolved into one where good help is not just hard to find, but hard to define. We’ve replaced productivity with a litany of managerial generalists to assure that some work gets done and there is a finger to point when it does not. No longer do we see skills being honed through apprenticeships and laborers vetted through guilds. These relics of a bygone era were once the validators of skill and capability by which master craftsmanship was attained. But then came along the jack of all trades and master of none, convincing us that suboptimal results are good enough if it absolves us of the responsibility to make difficult hiring decisions or taking on the responsibility ourselves.

The Solution

A brand new value system in the form of blockchains affords us a new paradigm. One in which the risk is balanced, and so is the reward. Where merit is earned and directly informs earnings. Where skill is assessed by peers (not recruiters), and the deliverables are measured by the client’s satisfaction. In this new ecosystem, there is no margin for ineptitude, as all ancillary resources must be allocated to informed innovation. Let’s break down how this works in practice.

A mission is established by a business entity, investment group or merely a band of friends (collectively known as “the founders”). This group is passionate about the mission, and willing to leverage their resources (financial, material and immaterial) to advance their ideas. The ideas may be nothing more than loose concepts; a sketch on the back of a napkin. The group need not have the answers to all of the questions… in fact, attempting to answer too many questions without the proper direction may derail the entire process and jeopardize the success of the mission. This is where the ninjas come in. They are a group of highly experienced, creative and connected individuals and recognized leaders in each of their disciplines, yet they have cross-industry knowledge and deep technology networks. Aside from expertise in building and incentivizing communities (through tokenomics), they are adept future thinkers and skilled technicians in all emerging fields (Blockchain, Artificial Intelligence, Extended Reality, Cloud Computing, Robotics) and can traverse the largest corporate hierarchy as deftly as they move through the entrepreneurial arena and pop culture, while accounting for legal liability, tax and securities complexities.

The ninjas are not an agency. The ninjas are an anti-agency. They can not be hired, they can only be commissioned. They are selective with the missions they take on, and only work with those aligned with the values of web3 and community. The ninjas care more about creating an engaging and equitable world than money, which is why there are no deposits, no retainers, and no invoices. Instead, the ninjas become partners to the founders, so that their objectives are aligned, and their incentives are clear. They deploy the founders’ funds - and sometimes their own alongside - to reach the end goal. The process flows like this:

A senior ninja (a “master”) will assess the ideas of the founders and consult with other masters to determine whether the mission aligns with the DAO ninja philosophy, and outlines a rough budget (convertible to various currencies including native ninja $hin, or shinobi tokens, and accounting for various tax systems in fiat conversions).

The founders will fund this budget which the ninjas will need to tap into (with transparency) in order to reach the desired goals. The remainder will be used to fund a treasury backing a native token of the mission.

The masters will assign a lead (“Sensei”) to the mission, who will establish the initial fundamental needs of the project (such as a roadmap, timeframe, budget line items and oversights), who will in turn work with the founders to establish clear objectives for the mission and identify various unknowns or pitfalls. The sensei may have any number of masters, senseis or subject matter experts as needed to establish a clear picture.

The founders will have a time-limited opportunity to assess the proposals issued by the ninjas and not proceed with the mission, in which case the ninjas will release the full budget minus expenses incurred and a percentage allocated to the collective for its time and effort. The ninjas will also open-source any work product unless it is expressly paid for by the founders and warrants rights-transfer. This is obviously designed as an opportunity for the founders to “shop around” for competitive pricing, and while it would be ill-advised, this is their one chance to abort the mission… Otherwise, the ninjas will proceed with the mission as planned.

The masters and Sensei will advise on the ideal business structures and regulatory considerations suited to the mission’s (and subsequent community’s) objectives.

Sensei will oversee the creation of a lightpaper to field community feedback and align incentives, and solicit ideas, which will be followed by a detailed project specification document.

After a brief feedback period, the sensei will make adjustments to the mission documents and assemble a team (a “clan”) to execute the mission, and launch the tools necessary to nurture a healthy community. Members of the team may be pseudonymous, moonlighting or side-hustling from their day jobs at Fortune 500 companies, startups, tenure or cushy government jobs. They will also each have apprentices, so that the next generation can learn to master the trade.

The clan will deploy native fungible tokens and any necessary non-fungible tokens as outlined by Sensei and the whitepaper. The founders will be issued the first set of tokens.

The clan will complete the mission and earn their payment in native tokens and $hin tokens along with a performance multiple based on the treasury value, and have an opportunity to participate in a pre-sale of tokens at a favorable price along with early community members and contributors.

The founders will then issue a token-sale to continue growth of the community and accelerate liquidity for the token, including defi primitives (such as staking, lending, pooling, arbitrage, etc) all with the continued guidance of the ninjas.

This mutually incentivized program will obviously afford the ninjas a higher compensation than an agency would get, but ONLY if the mission is successfully implemented. In return, the founders benefit from the most de-risked opportunity to see their mission executed, with the lowest investment possible. Ultimately with skin in the game for all parties, it is in everyone’s interest to maximize the opportunity by maximizing their effort.

In a market where there are more jobs than skilled labor, and a thoroughly confused base of recruiters and hiring managers, terrible hiring decisions are made regularly. We’re already seeing blockchain disrupting the workforce, and exacerbating the great resignation. In this new environment, we will surely see more jacks-of-all-trades popping up all over the place at corporations and agencies alike, but only a ninja can become a master. The opportunity for ninjas to shift the future of work in the ways of the DAO could not be clearer… yet hardly visible at all.

Alina’s Alignment

What are Alternative Asset Classes and How Tokenization is Changing the Industry?

One of the biggest problems with investing in alternative assets is it's very difficult to get started. The legal and regulatory hurdles that need to be overcome make it challenging for new investors. Many of the most interesting opportunities are open only to institutional investors or those who are "accredited" by the government (people with high net worth). This makes it extremely hard for everyday people to tap into these new investment opportunities, whether they are interested in real estate or fine art. Blockchain technology has changed this forever.

What are Alternative Asset Classes?

Alternative investments are generally considered to be assets that do not fall into one of the three conventional asset classes: stocks, bonds, or cash. These include physical assets such as commodities, real estate, and collectibles, and financial assets such as private equity, hedge funds, and derivatives.

Commodities: A commodity is anything that can be bought or sold with no differentiation between vendors. For example, gold is a commodity because an ounce of gold is the same no matter who sells it. Oil is another example of a commodity.

Real estate: Real estate includes any type of property that you can buy or sell — residential, commercial, or land.

Collectibles: Collectibles include art, antiques, coins, stamps, wine, and other high-end items. They are generally purchased for their investment value rather than the owner's personal use.

Alternative investments have been around for decades, but there has been a dramatic increase in investor interest over the past few years, with more money being invested in alternatives than ever before.

Why Invest in Alternative Assets?

The world of investing is full of different options. Some investors prefer stocks, while others go with bonds or mutual funds. But the best investment portfolios are made up of a mix of different types of investments and assets. This mix is known as asset allocation. Asset allocation helps to reduce the risk in your portfolio. Alternative assets are one type that reduces the investment risk.

Diversification

One of the main benefits of investing in alternative assets is that they provide an uncorrelated return profile to traditional asset classes. By investing in alternative assets, you can diversify your portfolio much more effectively than if you were only allocating funds to stocks or bonds.

Reduced Volatility

Alternative assets are typically much less volatile than traditional investments. This means that you will see fewer large swings in value in your investment account, and you won't need to worry about losing a lot of money when the markets fall.

Higher Returns

In general, alternative asset classes tend to provide higher returns than stocks or bonds over the long term. While this isn't always the case, there are many times when you will see a substantial increase in value within your investment portfolio due to these types of investments.

Hedge Against Inflation

Alternative assets have a tendency to outperform traditional investment classes during periods of high inflation or deflation, which makes them a great long-term hedge against inflation-driven economic downturns.

How Does Tokenization Work in the Real World?

Tokenization is the method of taking an asset, be it traditional or alternative, and fractionalizing it so that a larger number of investors can own a piece of the asset. In this way, tokenization enables smaller portions of an asset to be traded in an efficient manner.

In the real world, this means that an expensive asset can now be owned by many more people than would have been possible before tokenization. For example, art collectors might purchase a piece of work for $1 million but could then sell 5% of the artwork for $50,000 to another collector.

Currently, there are two ways in which assets are tokenized: 1) on-chain and 2) off-chain.

On-Chain Tokenization

This type of tokenization uses blockchain technology to create fractions of assets that can be traded as tokens on a blockchain network. As such, these assets are fully compliant with securities laws and regulations, as they are public and immutable on the blockchain.

Off-Chain Tokenization

This type of tokenization involves creating tokens backed by traditional assets without using blockchain technology. The tokens themselves do not reside on a decentralized network but instead are held in an escrow fund controlled by a centralized third-party entity.

Key Benefits of Tokenized Assets

Lower Barriers to Entry

Fractionalizing alternative assets makes them more accessible to a broader audience of investors. For example, the value of a single Picasso painting is out of reach for most people. But art lovers can buy fractions of it through a blockchain asset and take joint ownership of the painting.

Liquidity of Assets

Liquidity is improved by offering fractional ownership. When you own a piece of property or fine art, you can't easily trade it for something else in your portfolio. But once you upload that asset to your digital wallet as a token, selling becomes much easier because you're essentially selling shares in an investment vehicle that trades on an exchange and is easy to value.

Improved Transparency

Tokenization boosts transparency when all participants are required to store information about the asset on a blockchain ledger, where anyone with access to the network can view it. This eliminates the need for third-party verification from government agencies, lawyers, or brokers.

Conclusion

Blockchain technology has put the power to invest in alternative assets into the hands of the masses. For the first time, anyone can invest in these assets, which were previously restricted to accredited investors. This is a huge step forward for democratizing access to alternative investments. Tokenization has the potential to change how we invest in real estate, art, collectibles, and commodities.

My Two Cents…

Imagine if people could unite around ideas that matter to them and together form a community that can bring those ideas to life. That’s what DAOs can enable. It’s challenging right now to figure out how to get into a DAO, who to ask help from and the perks one could get when contributing to an early stage DAO. Web3 lacks a composable reputation layer.

At Two Cents, we are working on this reputation layer for people to more easily navigate through Web3 projects. We want to help people easily find, join and contribute to the DAOs and Web3 projects that matter to them. As a decentralised application, one can use Two Cents to view any wallet address on EVM-compatible blockchains. As a protocol, we also enable project creators of any size from an indie music creator to the largest DAO, to deploy their own smart contracts through no-code interfaces to recruit and reward people for helping in their projects.

Fairy Pixel Dust

A Primer on DAOs and their Central Role on the Blockchain

Are Decentralized Autonomous Organizations both decentralized and autonomous? Many do not know that there is no single answer to the question.

Answering becomes tricky because no two DAOs are created equal. Each DAO revolves around a common objective and its vision comes down to delivering a governance solution that is desirably on-chain. There have been a myriad of these epicenters popping up over the last year, and in case you are not familiar with the concept, you should know why it is one of the most crucial features of the blockchain revolution.

An important first note to make is there are numerous DAOs that differentiate themselves by their purpose and by their ability to afford autonomy to their tokenholders. In other words, DAOs make it possible for non-miners to have a say in the system in which they contribute. For decentralized finance platforms, the focus is a solid protocol with a fair governance mechanism like the UNI token offered by Uniswap. For investment-related DAOs, the concern is about proper allocation in a trustless system whose automation needs to be trusted. As institutional demand for decentralized solutions grows, you can expect trustworthy automation will attract a pretty penny. There is even a DAO of DAOs - check out GovernorDAO.

If you are a newcomer to the crypto space like myself, you might not have noticed these ghosts at play until you read about one. Needless to say, DAO members are active and busy working behind the scenes each day maintaining the web3 ecosystem!

Awesome enough – what’s the catch? A problem all too familiar to political and financial systems called the principal-agent issue. This dilemma arises when principals (individuals who are not miners) have interests that diverge from the developers within the DAO due to information asymmetry and other structural inadequacies.

Each DAO issues a governance token to a community with the intent to “align incentives” via automation, a hefty undertaking in any distributed system. The token incentivizes developers (the agents) to validate blocks by awarding them a cut of the transaction fees. During high volumes, DAOs can coordinate with other DAOs to delegate tasks and share the earnings. However, if the contract or platform is not properly developed as it often turns out, alignment of incentives becomes a misleading sales pitch. A double-edged Valyrian steel sword that non-miners (the principals) should not have to bear.

DAOs aim to distribute autonomy over its network to the extent dynamics allow for agency. Gas and transaction fees are a combined adversary to non-miner autonomy, which is restricted by the system in which they operate (the system the DAO oversees). Developers face their own agency issues when coordinating in the blockchain and those get passed on to the community in the form of slower transaction times, higher fees. There is no way for the collective principals to confirm if the DAO is in fact overburdened – this is called information asymmetry.

That leaves the principal and her agency to be fully reliant on the decentralized system to work without fail. It goes without saying everyone wants their defi apps to be comprehensively engineered, and so standards remain open today in search for better solutions. Unfortunately, given the inefficiencies still prevalent with current blockchain technologies, the concept of owner-miner antagonism is a real-world problem that remains unaddressed today.

A stark example of this notable pitfall is socially oriented DAOs. Personally, I have not encountered one that serves as a sufficient proxy for democratic processes for various reasons. Some platforms have monetized influencers, which is one bad mood from him ignoring the votes or worse one bad decision away per the influencer from losing your investment. That said, your money is your own risk-taking. A bigger problem with these kinds of DAOs is the lack of meticulous engineering for more complex systems. Some of these DAOs operate like a community of governance tokens, and in this case, you are likely better off emailing feedback and feature requests to the platform rather than paying fees to cast a vote.

Incentives fall apart for social DAOs when the platform attempts to monetize anything beyond simply bringing users together. Optimizing a system on human behavior comes at a cost that is human, but again, your time is your decision-making not your token. The structural alignment is simply nonexistent perhaps by design, but the outcome of votes casted is clearer with social DAOs than in any other DAO formation.

Other groups like gaming DAOs track user activity fully on-chain, and I believe the concept to be fully aligned with the dual purpose of the platforms they serve. Popular play-to-earn or #P2E games reward user activity with token ownership, but most offer no clear incentive in governance over the game.

As more DAOs pop up, the question becomes one of efficiency and effectiveness, not one of necessity. If the contracts are self-enforcing mechanisms, the myriad of DAOs will eventually become hubs that developers can hop to and fro trying to mine the most lucrative blocks, leaving behind cost-conscious non-miners where transaction fees become prohibitive. Agency in the gas prices you pay dissipates and non-miners fall victim to blockages and slow transaction processing, not just information asymmetry. Addressing the information gap and cartel-like gas pricing mechanism becomes a concern only for the non-miner, not the blockchain.

Concluding whether DAOs deserve the acronym is complicated. Besides the principal-miner-fee antagonism, there are other conflicts of interest. There is no way to know if your vote counted or if the DAO members are coordinated effectively on your behalf, but you can rest assured the miners earned the fee to record the vote nonetheless. The group making the decision may be homogenous or otherwise, but all DAOs share a common interest in accumulating fees, in direct conflict with principal agency. Are these fees conducive to autonomy or is decentralization simply a ploy to maintain high levels of income from fees?

Lipp Reading

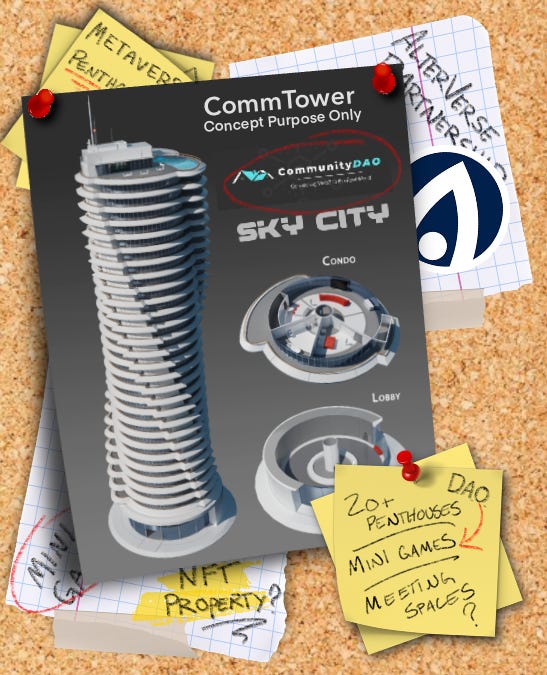

Community DAO Joins the AlterVerse as Partner in Building CommTower

AlterVerse, Inc. is proud to announce an official partnership with Community DAO, one of the first decentralized, autonomous organizations to fractionalize real estate ownership on the blockchain.

Community DAO offers their community with ownership in real world real estate, by means of property backed tokens on the blockchain. Their members are able to invest in real estate for as little as $50, by purchasing and trading dividend-paying, real estate shares 🚀🚀

In addition, Community DAO is investing in virtual property, taking advantage of the virtual real estate boom over the last few months.

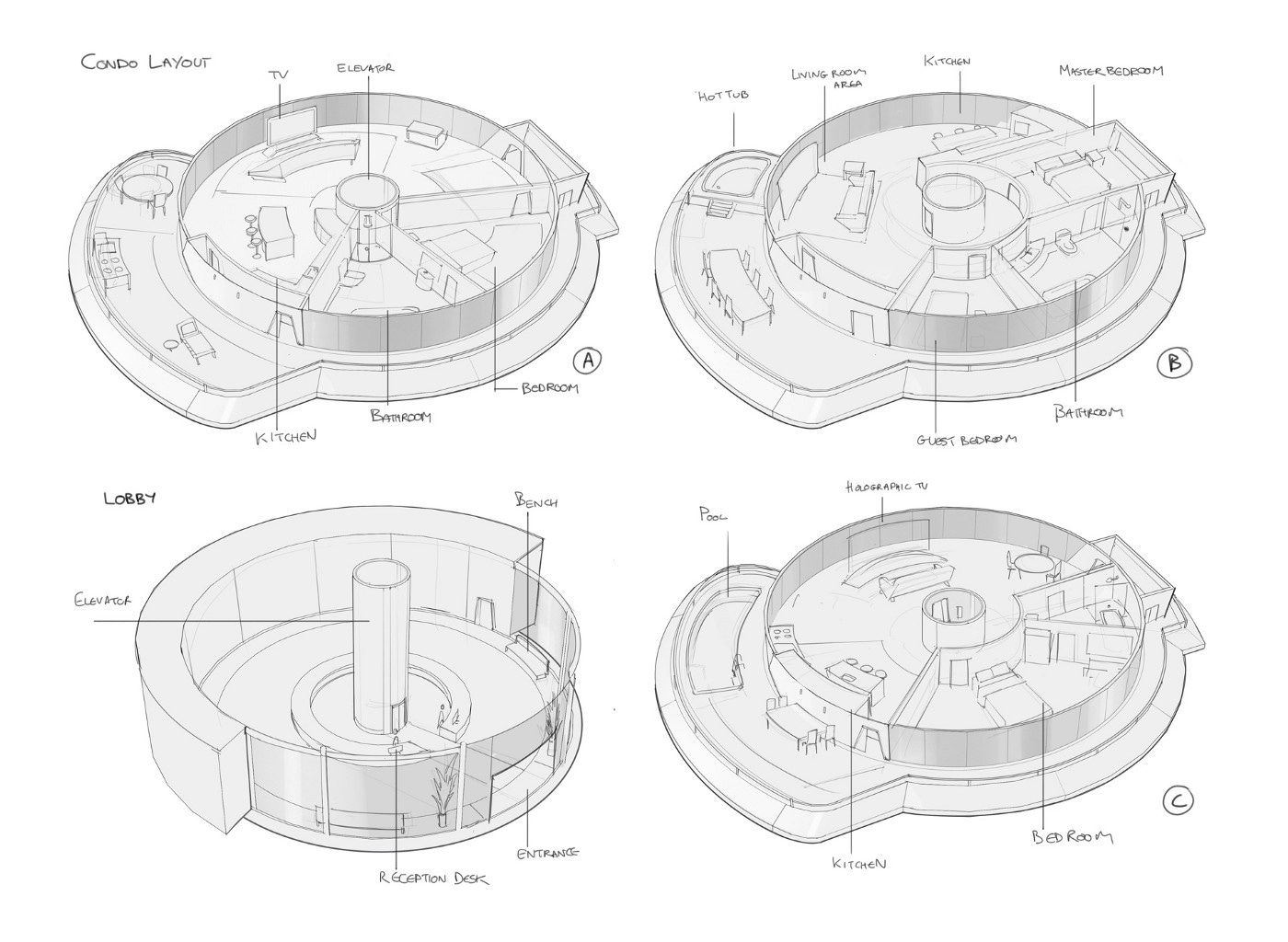

With our new partnership, Community DAO will be funding the construction of “CommTower” within the AlterVerse; offering their community members the ability to purchase exclusive ownership of 20+ floors of penthouse condos, along with providing a virtual space for their members to host meetings, attend educational training, play mini-games, and more!

(Initial concept image of CommTower penthouse floor plan)

When asked about their vision for CommTower, Co-Founder Dow Harris (aka DowDAO) replied:

“The multiplication of worlds, the confusion of boundaries, and the invasion of the realistic by the fantastic. This is the frontier we are developing. Immense potential, endless dreams, and a stake in the world to come. This is the trail we are blazing!”

Once CommTower has been built, we will be sharing instructions on how to buy.

Want to get in early? Be sure to join the Community DAO Discord channel: https://discord.gg/HGvVkFRD

The Community DAO $COMM token will soon be available to purchase on the RavenCoin blockchain.

The AlterVerse team is excited at the overall potential of being partnered with a leader in the real estate blockchain space, and the possibilities are nearly endless!

Be sure to follow Community DAO on Twitter and take a look through their website for more details 🥳

https://thecommunity.wtf/

—

Learn more about AlterVerse:

Join AlterVerse on Telegram: https://t.me/alterverse

Join the AlterVerse Discord: https://discord.gg/WuDHQmNkTx

Follow AlterVerse on Twitter: https://twitter.com/AlterVerseGame

Keys To the Kingdom

Analyzing The Ronin Bridge Hack

Summary (TLDR):

@AxieInfinity got hacked for $625M in crypto last week

No one noticed for a week

The team may need to sell equity to compensate users

This hack was different b/c it wasn't a smart contract exploit but rather a multi-sig one

Stolen funds haven't moved much yet

Axie is now top of the crypto hack leaderboard. $625M stolen.

How it happened

Why this hack is different

Where the money is now

Axie's road to recovery

summarizing insights by @WPeaster for @ScribeDAO

What happened?

Ronin sidechain is secured by 9 validator nodes. On March 23, an attacker comprised 5 nodes

The attacker used the nodes' signatures to withdraw ~625M USD of crypto

On March 29, a user tried to withdraw 5K ETH, alerting the team funds were gone

What's being done?

Sky Mavis (operator of Axie Infinity) paused the bridge and Ronin's Katana exchange

They're migrating their node infrastructure & engaging with law enforcement, crypto exchanges, & Chainalysis to encircle the culprit.

All Ronin funds are now safe.

Sky Mavis is debating how to move forward to ensure no users' funds are lost - @adamscochran speculated that they may end up selling equity to cover losses from the attack

And to raise enough to cover this from equity, would probably mean selling 20%-30% of Sky Maven (assuming discount on last $3B valuation, as this capital is used for recovery and not growth, so would be a down round)

Why this hack is different?

The Ronin bridge hack didn't result from a smart contract exploit like in other recent attacks - The Ronin bridge attack resulted from a multi-sig compromise - The actual vector of compromise remains unclear

@kelvinfichter· Mar 29

“This is very different from previous bridge hacks where the root cause was a smart contract bug. This is a much more "classical" hack of private keys in a multi-key security setup. This is why trust-minimized bridging is SO important.

What does this mean for validator-based bridges?

The attack was catastrophic b/c the attacker was able to compromise 5 of 9 nodes in one go

Sky Mavis has raised Ronin's validator threshold from 5 to 8, but will likely further decentralize and increase total validators

More nodes spread across more community-run or 3rd party projects combined w/ multiple software clients would've prevented the attack

The attack will spur more attention & development around trust-minimized or "trustless" bridges moving forward

Where is the money now?

The vast majority of stolen funds ($589M) are still sitting in 1 of 3 addresses used in the attack

The attacker sent some ETH to centralized exchanges like FTX to test if they could cash out to fiat

How will the hacker hide money? - Most blackhat hackers in the ETH ecosystem mix stolen ETH via privacy solution Tornado Cash to "clean" the funds - It's odd that the attacker sent funds straight to a centralized exchange w/o using Tornado first

@Mudit__Gupta · Mar 29

- “I'm 99% sure that the hacker is someone seasoned with a lot of cybersecurity experience (not a crypto degen kid). It's naive to think that such an attacker will transfer money to his own accounts on CEX like FTX or Crypto. It's either a honeypot or they are using money mules.”

So where does this leave Axie?

The Ronin bridge attack was a major setback for the Axie ecosystem

If any team-community combo can bounce back stronger, it's Sky Mavis & the Axie community

Now we'll see what the hacker does w/ the $ next...

Nonfungible Fungi 🍄🍄🍄

Voice is becoming a tool for DAO Contributors

Voice started out as a Site to discover social tokens, to a site to a Site to Discover DAO, to a Site that helps you Join and Contribute to DAOs all in a bid to stand out and help achieve the web3 dream.

Today we pivot into a platform for DAO Contributors to keep up with weekly Updates from their favorite DAOs. Most of you are part of a ton of DAOs and knowing everything that happened in those DAOs is pretty hard, so we’ll give weekly TLDR Summaries of the Events that went down in Each DAO.

In one sentence “Voice is a collaborative dashboard where contributors can keep up-to-date on their favorite DAOs.”

The Voice Dashboard highlights the best DAOs for contributors, with helpful information such as:

Detailed DAO profiles

Community contributor rating system

Important DAO announcements all in one place

DAO metrics & weekly updates

Onboarding guides

Read the latest blog posts & articles

Find new bounties early

Token prices

Hop into our discord to keep up with Voice: https://discord.gg/P24Drm3EXa

Ambassador Report

From the warehouse of great minds who are creative in their different areas, we've brought before users on Twitter, Reddit, Instagram, YouTube, Facebook, TikTok and medium the adoption of Commtoken logo, launching of Commtoken on its way, and continuation of invites to our Twitter handle, Discord and website at large. The ambassadors also shared the latest news published on our different social media handles and made memes to create lively atmospheres in our hashtags on Twitter, LinkedIn and YouTube.

Leaderboard/Ranking

Rank Twitter username

Alochinonye

Julietsandy6

IgnatiusXario

Yhuddee111

Gladnezmfon

Vivichery

AdubaChukwudum

Kuficute

Wirdyoniell

Mhizfab11

Dani_BeeHive

Nsikreationz

Emilyntweet

BlessingWinner

Ideal_Spec

UyBeneu

Sirmuel1000

bietDeFi

Dr_Khanzie

_perculiaj

Industry News

A Guide for designing online community governance

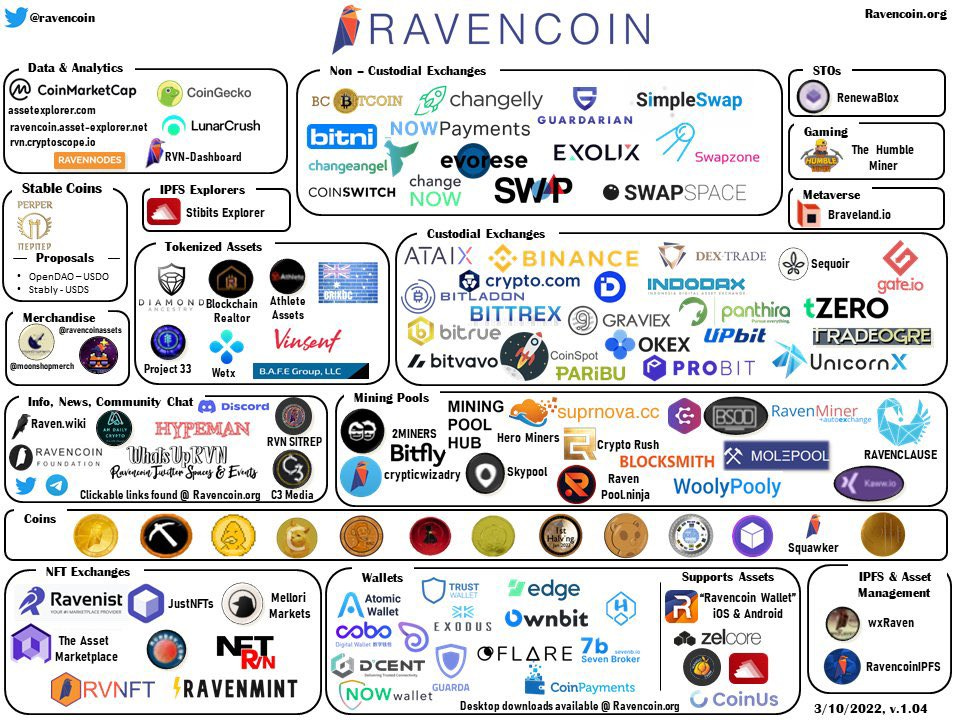

Ravencoin

Ravencoin (RVN): A Blockchain for Launching Tokens